Financial services

Adaptive identity for smarter security

Govern access for every human and non-human identity to protect your institution and maintain customer trust.

Challenge & solution

The cost of compromise is too high

Financial institutions face relentless cyber threats, compounded by the complexity of managing identities across hybrid systems. Manual processes also leave security gaps which open the door to data breaches and compliance failures.

Manage and control all identities

Centralize identity governance for holistic visibility and control across hybrid and legacy systems.

Enforce zero trust to help mitigate insider threats and secure sensitive financial data.

Manage and secure access for human, machine and AI agent identities.

Assign access rights based on roles to streamline management, enforce security, and assist compliance.

Automate identity lifecycles with AI to increase efficiency and reduce manual errors.

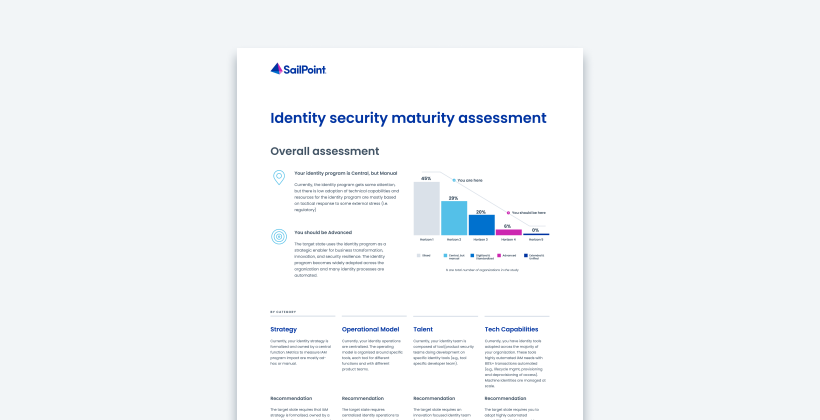

Special report

State of identity security in financial services

Organizations report manual processes, and overprovisioning access leaves them vulnerable to risk and compliance issues. Discover insights like these and other key findings to drive your financial institution forward.

Benefits

Secure your institution with AI-driven identity

In financial services, security and compliance aren’t optional—they're essential. SailPoint’s adaptive identity platform empowers you with unmatched visibility and control to help safeguard sensitive data, simplify regulatory compliance, and increase operational efficiency. Automate access and enforce zero trust principles to mitigate risk, build customer trust, and enable secure digital transformation.

Proactively mitigate risk and protect assets

Enforce a zero trust model to secure financial data. Gain visibility into access for all human, machine, and AI agent identities, identify and remediate risks, and mitigate insider threats before they cause costly and possibly irreparable damage.

Key offerings

Take your identity security solution even further

SailPoint Identity Security Cloud delivers the essentials for most organizations. SailPoint also offers advanced capabilities for specific needs.

Customer Stories

Trusted by top financial firms

Resources

Expand your identity security expertise

FAQ

Frequently asked questions

How can SailPoint help financial institutions implement and support a zero trust security model?

SailPoint's adaptive identity platform can help financial institutions enable zero trust by delivering continuous visibility, risk-based access controls, and automated policy enforcement. These capabilities help ensure that only the right users—whether employees, third parties, or non-human identities—have appropriate access to sensitive data, strengthening security and compliance across complex, hybrid environments. Learn more.

How can we securely manage access for third-party contractors and vendors?

SailPoint Non-Employee Risk Management automates third-party onboarding, manages risk-based access, and ensures rapid deprovisioning. Learn more.

Can you help with DORA and SOX compliance?

Yes. Our platform automates access reviews and maintains comprehensive audit trails. This simplifies the process of proving compliance with strict regulations like DORA, SOX, and GDPR. Learn more.

Does this work with legacy banking or other financial services systems?

Yes. SailPoint creates a unified governance layer that connects modern cloud applications with legacy on-premises infrastructure, ensuring consistent policy enforcement across your entire hybrid environment. Learn more.

How can AI help improve our security posture?

Our AI capabilities analyze access patterns to detect high-risk access. It provides predictive insights and recommendations, allowing you to proactively address potential threats rather than just reacting to them. Learn more.

How can we accelerate our compliance readiness?

SailPoint Accelerated Application Management provides continuous insight into application inventory, ownership, user activity, and risky access. Quick Compliance Connectivity offers a streamlined approach to rapidly onboard ungoverned applications. Learn more.

Contact us

Secure your institution today

Don’t let identity gaps put your financial organization at risk. See how SailPoint can help strengthen your security and streamline compliance.